The Red Flags Rule Federal law requires banks investment brokers mutual funds and other creditors to adopt identity theft prevention programs. Respond appropriately to the detected red flags.

Red Flags Rule Is Your Dealership In Compliance

Red Flags Rule Is Your Dealership In Compliance

The Red Flags Rules require financial institutions and creditors that offer or maintain covered accounts to have policies and procedures to identify patterns practices or activities that indicate the possible existence of identity theft to detect whether identity theft may be.

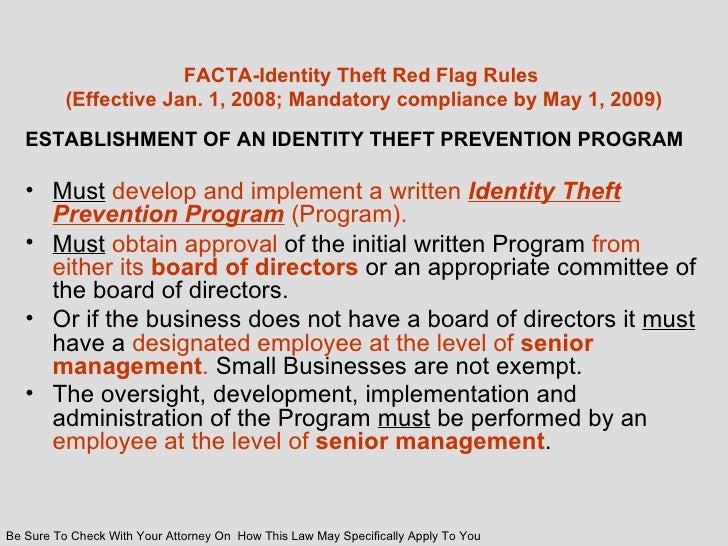

Identity theft red flags. Detect the occurrence of those red flags. 2 The rules implement Sections 114 and 315 of the Fair and Accurate Credit Transactions Act 2003 and require among other things that. The Fair and Accurate Credit Transactions FACT Act PDF requires financial institutions with covered accounts to develop and implement a written identity theft prevention program designed to detect prevent and mitigate identity theft in connection with opening new accounts and operating existing accounts.

It can disrupt your financescredit history and reputationand take timemoney and patienceto resolve. Review any reports such as audit reports and annual reports prepared by staff for the board of directors or an appropriate committee thereof or a designated senior management employee on compliance with the Red Flag Rules including reports that address. The purpose of a red flags program is to detect patterns practices and specific forms of activity that indicate the existence of identity theft and prevent a customer from using false identifying information to obtain goods services or credit.

The SECs identity theft red flags rules require certain SEC-regulated entities to adopt a written identity theft program that includes policies and procedures designed to. As an example if a patient presents what appears to be altered or forged identification that would be a flag. Go through trash cans and dumpsters.

The US government audit of a companys compliance with the Red Flags Rule may be inevitable as the number of identity theft cases increases affecting more people and their credit worthiness. 1 Identify Relevant Red Flags. To comply with the Identity Theft Red Flags Rules Red Flag Rules.

The identity theft red flags rule refers to another one of these efforts undertaken by financial institutions and creditors. A government audit of a companys identity theft prevention program as agreed by an inter-agency committee will cover three major aspects of the Red Flags Rule. The purpose of an identity or medical identity theft protection plan is to identify flags or triggers that would indicate identity theft may be occurring.

Identity thefthappens when someone steals your personal informationand uses it without your permission. Identitytheft is a serious crime. 1 A red flag is defined as a pattern practice or specific activity that indicates possible identity theft.

A red flag is a pattern practice or specific activity that indicates the possible existence of identity theft. 1 For purposes of these examination procedures financial institutions and creditors are referred to jointly as. The program has four elements.

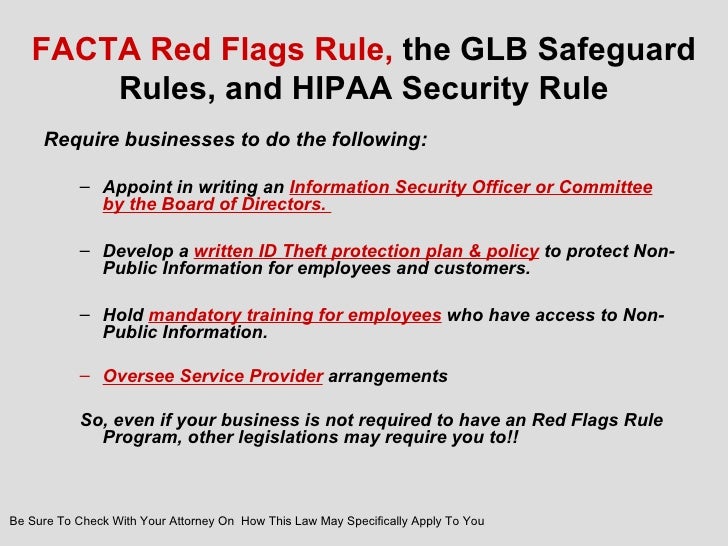

Fortunately the Red Flags Rule provides financial institutions and creditors with significant flexibility. Identity Theft Red Flags Rules. The Red Flags Rule sets out how certain businesses and organizations must develop implement and administer their Identity Theft Prevention Programs.

Are you up on the Red Flags Rule. What is Identity Theft. Sometimes i ts referred to as one of the Fair Credit Reporting Act s Identity Theft Rules and it appears in the Code of Federal Regulations as Detection Prevention and Mitigation of Identity Theft The Red Flags Rule requires many businesses and organizations to implement a written Identity Theft Prevention Program designed to detect the warning signs or red.

Identify relevant types of identity theft red flags. The Red Flags Rule requires that each financial institution or creditorwhich includes most securities firmsimplement a written program to detect prevent and mitigate identity theft in connection with the opening or maintenance of covered accounts These include consumer accounts that permit multiple payments or transactions such. The program must include four basic elements which together create a framework to address the threat of identity theft.

A Red Flag is a pattern practice or specific activity that indicates the possible existence of identity theft 2 It is purposely broad the intention being to cast a wide net.

5 Identity Theft Red Flags Infographic Compli

5 Identity Theft Red Flags Infographic Compli

The Red Flags Rule Identity Theft And Debt Collectors

The Red Flags Rule Identity Theft And Debt Collectors

Identity Theft Prevention And The Red Flag Rules

Identity Theft Prevention And The Red Flag Rules

Id Theft Red Flags Essential Elements Of Customer Awareness

Id Theft Red Flags Essential Elements Of Customer Awareness

Counterfeit Money Detector And Identity Theft Prevention Blog Red Flag Rules

Counterfeit Money Detector And Identity Theft Prevention Blog Red Flag Rules

Designing An Effective Identity Theft Red Flags Rule Compliance Program Identity Theft Handbook Wiley Online Library

Designing An Effective Identity Theft Red Flags Rule Compliance Program Identity Theft Handbook Wiley Online Library

Identity Theft Red Flags Rule Examination Procedures Identity Management Institute

Identity Theft Red Flags Rule Examination Procedures Identity Management Institute

How To Know If The Id Theft Red Flags Rule Applies To You

How To Know If The Id Theft Red Flags Rule Applies To You

Identity Theft Red Flags Rule Compliance Survival Guide

Identity Theft Red Flags Rule Compliance Survival Guide

Identity Theft Red Flags Rule For Business

Identity Theft Red Flags Rule For Business

Federal Rules Protecting Your Identity Could Soon Change Abc11 Raleigh Durham

Federal Rules Protecting Your Identity Could Soon Change Abc11 Raleigh Durham

Guarding Against Identity Theft Glba Red Flag Rules And Student Awareness

Guarding Against Identity Theft Glba Red Flag Rules And Student Awareness

Identity Theft Prevention Program Checklist Northwest Credit Union Association

Identity Theft Prevention Program Checklist Northwest Credit Union Association

Identity Theft Red Flags Rule For Business

Identity Theft Red Flags Rule For Business

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.